Demand for the minerals needed to fuel the low-carbon energy transition presents a timely moment for resource-rich developing countries to increase their revenues while helping combat climate change. The clean energy technologies for such a transformation will require an estimated global production increase of up to 500% for critical minerals like copper, graphite, and lithium by 2050. These resources are abundant in many developing countries.

To fully benefit from this spike in demand, countries are already updating their fiscal frameworks, and we expect to see more countries amending their benefit-sharing frameworks to increase their resource revenues.

To advance important policy developments for member countries, the African Tax Administration Forum (ATAF) and the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) launched the Future of Resource Taxation in 2020. The initiative brings together government and non-government stakeholders to exchange ideas on how the current system of mining taxation can be improved, as well as alternative options available to resource-rich countries to maximize the returns from their mineral wealth.

Between August and September 2021, we conducted a survey of government officials working in ministries of mines and finance, as well as audit institutions and tax authorities. Below we share survey results and analysis that provide insights into the fiscal objectives of mining countries and challenges to mining revenue collection. A total of 97 officials from 49 countries in Africa, Asia, and South America responded to the survey.

Analysis

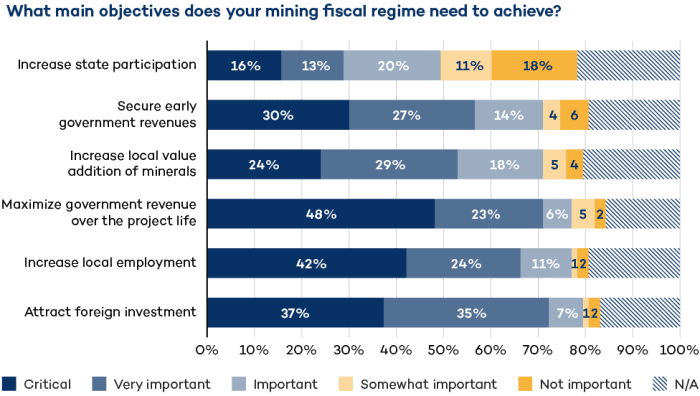

Respondents are overwhelmingly open to mining investment, but they seek tangible benefits in the form of jobs, revenue, and economic activity. Governments use different combinations of fiscal instruments to meet their objectives. For example, mineral royalties provide an early source of revenue while resource profit-based taxes maximize revenue over the life of the project. State participation gives governments a right to dividends from a mining project. Government can also use non-fiscal tools such as local content policies to increase local employment and value addition.

However, these objectives are not always met to full satisfaction. Key challenges preventing governments from achieving their objectives can be summarized in three areas: policy, administrative, and tax base erosion and profit shifting (BEPS) challenges, as described below.

Analysis

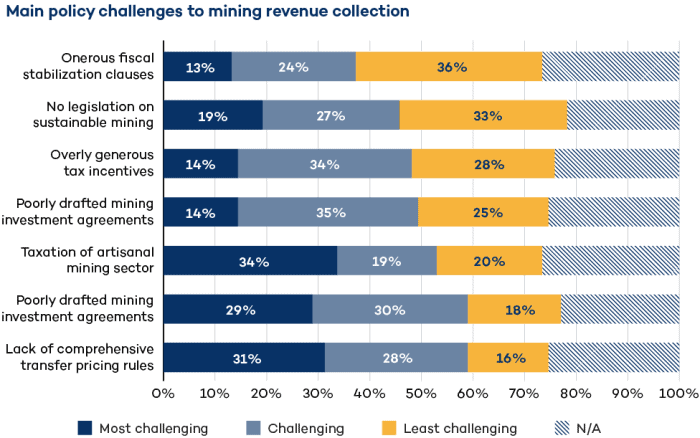

The basic building blocks for maximizing revenue collection lie in the legislative and fiscal framework, and more than half of the participants indicated they are working under poorly crafted or outdated regimes. When legislation is not fit for purpose or includes loopholes, revenue collection suffers. In addition to abusive transfer pricing and other artificial profit shifting (more on this below), survey participants highlighted problems with fiscal incentives that are commonly extended to attract mining investment and that are rarely shown to be worth the corollary loss of government revenue. Taxation of artisanal mining presents its own challenge due to high levels of non-compliance and the administrative burden imposed on the tax administration in trying to rake them into the tax net. Fiscal stabilization clauses can lock in bad decisions, making it difficult for countries to correct any poorly drafted contacts or legislation.

Analysis

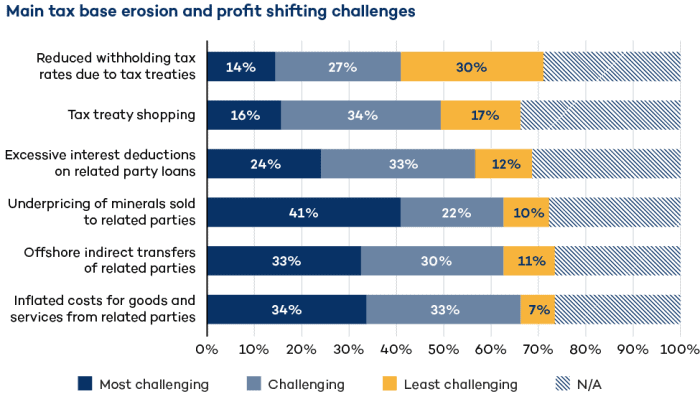

At the heart of the identified BEPS challenges is transfer pricing. The practice is also known as transfer mispricing, whereby multinationals artificially manipulate prices in intra-company transactions to reduce their global tax bill by shifting profits from high-tax to low-tax jurisdictions. In the mining industry, transfer pricing often manifests as underpriced mineral sales exports from developing countries to foreign related parties—or inflated costs for goods and services purchased by the mining company from related parties. Excessive interest deductions on related-party loans manifest as another major BEPS challenge.

Even with access to publicly quoted prices, mineral pricing can be difficult, as governments may have to make complex adjustments to reflect differences in mineral quality, level of processing, and payment terms, which all pose revenue collection risks. ATAF developed a toolkit for transfer pricing risk assessment in the African mining industry and a suggested approach to drafting transfer pricing legislation.

Analysis

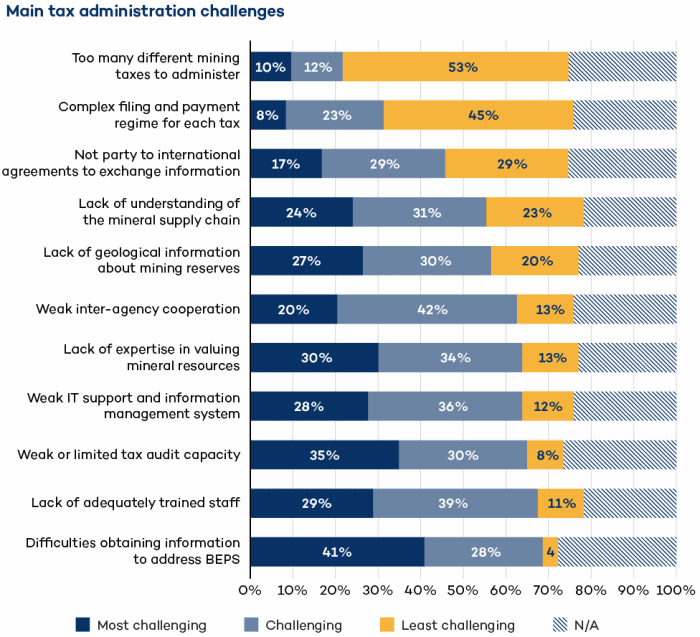

A country can have a sound fiscal framework, but if it is poorly administered, it will not collect the expected revenues. Respondents pointed to a lack of information, from geological data to supporting documents on related-party payments, that can seriously undermine the government’s policy and administration functions. Many also pointed to limited tax audit capacity and weak information management systems as a challenge, as well as difficulties in inter-agency coordination that can be key to governing the resource sector. Building administrative capacity and expertise is a core focus for both the IGF and the ATAF.

Conclusion

Resource-rich developing countries face many challenges in collecting mining revenue, which require unique responses for countries to meet their objectives and make the most of their resources. With the growing demand for minerals, especially considering the expected need for critical minerals for the energy transition, this is the right time for the IGF and the ATAF to take stock and investigate how the current system of mining taxation operates—and these survey results point to a way forward.

In the coming months, we will use these results, as well as additional inputs from government and non-government stakeholders, to unpack and publish the most innovative and forward-looking policy options so governments can consider them as they review their mining fiscal policies.