For many countries, mineral resources represent a vital opportunity to achieve much-needed economic and social development.

However, the financial promise of mining can go unfulfilled when host governments are unable to collect their fair share of financial benefits. This can be due to poorly drafted contracts, poorly designed fiscal policies and tax incentives, or aggressive tax planning by multinationals.

Collecting fair revenue and sharing benefits also builds trust, which is key to strong mineral supply chains that support economic development. This is especially important today, as the global economy demands critical mineral inputs for new technologies and the transition to low-carbon energy.

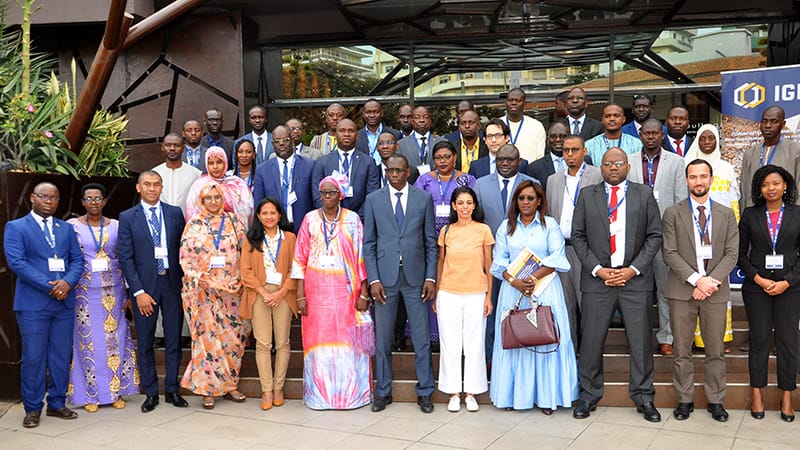

In accordance with the IGF’s cornerstone Mining Policy Framework, the Secretariat supports member countries in building and administering mining fiscal regime measures that secure their fair share of revenues from the sector.

Global Mining Tax Initiative

The Global Mining Tax Initiative is the main component of the IGF’s work on financial benefits. It is a distinct program offering for IGF member countries that covers fiscal policy for the entire mining value chain, from exploration and development to mining, processing, mineral sales, and mine closure. This specialized and comprehensive work program focuses on all aspects of fiscal policy, including taxes, royalties, and financial modelling. It shares unique expertise on international tax challenges related to the global mining sector.

The Future of Resource Taxation

The IGF partnered with the African Tax Administration Forum to rethink how developing countries benefit financially from their mineral resources. We launched The Future of Resource Taxation in 2020, a research project to discover how the existing system of mining taxation can be improved and identify new, innovative fiscal options for resource-rich countries to maximize the returns from their mineral wealth.

The project crowdsourced and developed policy ideas from governments, civil society, academia, and industry. The end result is a handbook for policy-makers: The Future of Resource Taxation: 10 Policy Ideas to Mobilize Mining Revenues. It presents a menu of innovative fiscal measures to strengthen revenue collection in the mining sector.