Comprising much of the southern region of South America, Argentina is the world’s eighth-largest nation by area and home to 45 million people. It also hosts a variety of mineral resources, including lithium and copper, key minerals for the low-carbon energy transition. Argentina hosts the world’s second-largest lithium reserves, and in 2022, it was the fourth-highest lithium producer globally. While there is currently no copper production in the country, there are large undeveloped deposits of the red metal, and the large Josemaría copper mine currently under construction is set to start up by 2025. Mining represents an important development opportunity for the country, and the government is keen to grow the sector.

The Challenge

With more than 30 advanced but undeveloped mineral development projects in the country, the Secretariat of Mining within Argentina’s Ministry of Economy has a targeted program to facilitate the development of mining projects. The goal is to increase government revenue and economic growth through mining while safeguarding the environment and respecting the rights of workers and communities.

The government is keen to make the most of expected increases in demand for minerals, such as copper and lithium, linked to the energy transition. While Argentina is rich in minerals, officials wanted to know if the country’s tax and broader fiscal regime could be improved to facilitate the development of mineral deposits into revenue-generating mines. The government was concerned that some elements of the fiscal regime for mining did not account for taxpayers’ ability to pay and were, therefore, deterring investment in the sector.

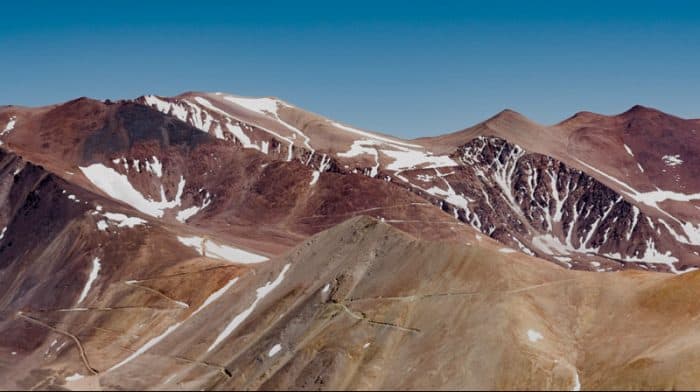

The Josemaría copper project. Source: Argentina’s Secretariat of Mining

Our Role

Government officials requested the IGF’s assistance with financial modelling to benchmark Argentina’s mining fiscal regime against three other mining jurisdictions: Chile, Peru, and Western Australia.

A financial model is a fundamental tool for assessing the economic viability of a proposed project and can help governments negotiate contracts with mining companies, for instance, to optimize economic benefits and weigh the costs and benefits of tax incentives. Financial modelling can also provide project-level economic and financial analysis to help evaluate fiscal policies. Financial models for mining must incorporate many complex variables—from local geology and metallurgy to macroeconomic trends—to accurately estimate the costs to build and operate a mine, as well as the expected revenue from selling minerals that can fluctuate in price.

The IGF’s Global Mining Tax Initiative has developed expertise in financial modelling for mining projects and began working with the government in May 2020 to build models for three advanced mineral projects: Navidad, Josemaría, and Agua Rica. Building these models entailed multiple exchanges with various Argentine government agencies involved in collecting mining revenues, including representatives from the provincial governments and mining investors.

The Josemaría copper project. Source: Argentina’s Secretariat of Mining

By early 2021, the IGF delivered a report with a quantitative and qualitative analysis of the three financial models. The report also included fiscal policy analysis and recommendations for reforming the current mining tax regime in Argentina to optimize government revenues while supporting investment in these three examined projects. The IGF recommended that the country consider adopting measures that adapt to commodity price swings, such as variable royalty rates—one of the innovative fiscal policy ideas that the IGF was researching as part of The Future of Resource Taxation initiative.

Beyond creating these models and reports for the government, the IGF also worked to ensure that government officials had the capacity to build mining financial models themselves in the future, given the number of undeveloped mineral projects throughout the country.

This cooperation with the IGF allowed us to build financial models for mining projects, providing us with a methodological framework and informing economic and tax policy recommendations to promote mining investment in a sector considered strategic by the national government.

– Jorge Andrés Vera, former Subsecretary of Mining Development, Secretariat of Mining

Our Impact

Financial Modelling Group

Equipped with enhanced technical knowledge and capacity from the IGF’s engagement, the Secretariat of Mining created a group tasked with developing and analyzing financial models to assess the viability of significant mineral projects.

“This cooperation with the IGF allowed us to build financial models for mining projects, providing us with a methodological framework and informing economic and tax policy recommendations to promote mining investment in a sector considered strategic by the national government,” said Jorge Andrés Vera, who served as Subsecretary of Mining Development with the Secretariat of Mining when the group was created.

“We must proceed to analyze the portfolio of potentially viable projects, with special emphasis on lithium,” said Vera. “This mineral, as well as copper, [is] critical to the transition to green economies, based on electromobility, renewable energy, and the sustainable development of natural resources.”

The financial model we developed with the IGF helped us design a sliding scale duty on copper exports.

–Pablo Gallo, former Chief of Cabinet, Secretariat of Tax Policy, Ministry of Economy

To complement these efforts, the government has moved to implement its Mining Investment Law with Resolution No. 119/2020 to ensure investors provide authorities with detailed affidavits containing financial information such as operating costs and tax contributions. These details are important to help the government understand and model the economic viability of projects and monitor and manage the sector more efficiently.

Sliding-Scale Copper Export Duty

Based on the financial models and recommendations developed with IGF, the Ministry of Economy created a new, optional tax regime for copper exports in 2022. As an alternative to the usual 4.5% export levy, companies can now opt for a sliding-scale regime where the tax rate changes from 0% to 8% depending on the price of copper. It is designed to ensure the government can collect more revenue when companies have the ability to pay while reducing the financial burden in more challenging times. Among other benefits, using variable rates negates the need for governments to adjust rates to keep up with price changes, and they are easier to implement than profit- or cash-flow-based taxes. The company building the Josemaría copper mine has expressed an interest in the new sliding-scale regime.

“The financial model we developed with the IGF helped us design a novel policy instrument for mining in Argentina. It is a progressive instrument, a sliding scale duty on copper exports, aimed at capturing mining rent. This instrument provides flexibility in the face of price volatility and reduces uncertainty in the Argentine mining regime, encouraging investment and strengthening revenue collection,” said Pablo Gallo, who served as Chief of Cabinet of the Secretariat of Tax Policy of the National Ministry of Economy.

This story was first published in February 2022 and updated in February 2024.

Argentina innova con los derechos de exportación y utiliza modelos financieros para liberar su potencial económico

Argentina ocupa gran parte de la región meridional de Sudamérica, es el octavo país más grande del mundo en superficie y tiene 45 millones de habitantes. También alberga diversos recursos minerales, como el litio y el cobre, minerales clave para la transición energética con bajas emisiones de carbono. Argentina alberga las segundas mayores reservas de litio del mundo y en 2022 fue el cuarto mayor productor mundial de litio. Aunque actualmente no hay producción de cobre en el país, existen grandes yacimientos sin explotar del metal rojo, y la gran mina de cobre Josemaría, actualmente en construcción, se pondrá en marcha en el 2025. La minería representa una importante oportunidad de desarrollo para el país, y el Gobierno está muy interesado en el crecimiento del sector.

El desafío

Ante los más de 30 proyectos mineros avanzados pero sin desarrollar en el país, la Secretaría de Minería del Ministerio de Economía de Argentina tiene un programa específico para facilitar su realización. El objetivo es aumentar los ingresos públicos y que haya un crecimiento económico a través de la minería, sin dejar de salvaguardar el medioambiente y respetar los derechos de los trabajadores y las comunidades.

El Gobierno quiere aprovechar al máximo los aumentos previstos de la demanda de minerales, como el cobre y el litio, vinculados a la transición energética. Si bien Argentina es rica en minerales, los funcionarios querían saber si el régimen tributario del país podría mejorarse para facilitar la explotación de yacimientos mineros que permitan generar ingresos. Al Gobierno le preocupaba que algunos aspectos del régimen fiscal aplicable a la minería no contemplaran la capacidad de pago de los contribuyentes y que, por tanto, se disuadiera de invertir en el sector.

Nuestra función

Algunos funcionarios del Gobierno solicitaron la ayuda del IGF para la elaboración de modelos financieros que compararan el régimen fiscal minero de Argentina con el de otras tres jurisdicciones mineras: Chile, Perú y Australia Occidental.

Un modelo financiero es una herramienta fundamental que permite evaluar la viabilidad económica de un proyecto propuesto y puede ayudar a los Gobiernos a celebrar contratos con empresas mineras para, por ejemplo, optimizar los beneficios económicos y sopesar los costos y beneficios de los incentivos fiscales. Los modelos financieros también pueden proporcionar análisis económicos y financieros a nivel de proyecto para ayudar a evaluar las políticas fiscales. Los modelos financieros para la minería deben incorporar muchas variables complejas que abarcan desde la geología y la metalurgia locales hasta tendencias macroeconómicas a fin de calcular con precisión los costos de construcción y explotación de una mina, así como los ingresos previstos a partir de la venta de minerales cuyo precio puede fluctuar.

A través de la Iniciativa Global de Impuestos a la Minería del IGF con experiencia en la elaboración de modelos financieros para evaluar proyectos mineros se comenzó a trabajar con el Gobierno en mayo de 2020 para construir modelos para tres proyectos mineros avanzados: Navidad, Josemaría y Agua Rica. La elaboración de estos modelos implicó varios intercambios con distintos organismos gubernamentales argentinos involucrados en la recaudación de ingresos mineros, incluidos los representantes de los gobiernos provinciales y los inversores mineros.

A principios de 2021, el IGF entregó un informe con un análisis cuantitativo y cualitativo de los tres modelos financieros. En el informe asimismo se incluía un análisis de la política fiscal y recomendaciones para reformar el actual régimen fiscal minero en Argentina con el fin de optimizar los ingresos públicos y, al mismo tiempo, apoyar la inversión en estos tres proyectos examinados. El IGF recomendó que el país considerara la adopción de medidas que se adapten a las oscilaciones de los precios de las materias primas, como los cánones variables, una de las ideas innovadoras en materia de política fiscal que el IGF estaba investigando en el marco de la iniciativa El futuro de la tributación de los recursos naturales.

Además de crear estos modelos e informes para el Gobierno, el IGF también trabajó para garantizar que los funcionarios del gobierno tuvieran la capacidad de crear ellos mismos modelos financieros mineros en el futuro, dada la cantidad de proyectos mineros sin desarrollar en todo el país.

Nuestro impacto

Grupo de modelos financieros

La Secretaría de Minería, dotada de mayores conocimientos técnicos y capacidad gracias a la participación del IGF, creó un grupo encargado de elaborar y analizar modelos financieros para evaluar la viabilidad de importantes proyectos mineros.

“Este trabajo conjunto con el IGF nos permitió elaborar modelos financieros para proyectos mineros, nos proporcionó un marco metodológico y recomendaciones de política económica y tributaria para promover la inversión minera en un sector considerado estratégico por el Gobierno nacional”, informó Jorge Andrés Vera, quien se desempeñaba como subsecretario de desarrollo minero de la Secretaría de Minería cuando se creó el grupo.

“Debemos proceder a analizar la cartera de proyectos potencialmente viables y hacer especial hincapié en el litio”, afirmó Vera. “Este mineral, al igual que el cobre, es crítico para la transición hacia economías ecológicas, basadas en la electromovilidad, las energías renovables y el desarrollo sustentable de los recursos naturales”.

Para complementar estos esfuerzos, el Gobierno ha puesto en marcha su Ley de Inversiones Mineras a través de la Resolución n.º 119/2020 con el fin de garantizar que los inversores presenten a las autoridades declaraciones juradas detalladas con información financiera, como los costos de explotación y los aportes fiscales. Estos detalles son importantes, ya que ayudan al gobierno a comprender y modelar la viabilidad económica de los proyectos y supervisar y gestionar el sector de forma más eficiente.

Derecho de exportación de cobre de escala móvil

Según los modelos financieros y las recomendaciones desarrolladas con el IGF, el Ministerio de Economía creó un nuevo régimen fiscal opcional para las exportaciones de cobre en 2022. Como alternativa al habitual gravamen a la exportación del 4,5 %, las empresas pueden optar ahora por un régimen de escala móvil en el que la tasa impositiva varía del 0 % al 8 % en función del precio del cobre. Este régimen se creó para garantizar que el Gobierno pueda recaudar más ingresos en caso de que las empresas tengan capacidad de pago y a la vez reducir la carga financiera en tiempos más difíciles. Entre otras ventajas, el uso de tasas variables evita que los gobiernos tengan que ajustar las tasas en función de las variaciones de precios, y son más fáciles de aplicar que los impuestos basados en los beneficios o el flujo de caja. La empresa que construye la mina de cobre Josemaría ha manifestado interés por el nuevo régimen de escala móvil.

“El modelo financiero que desarrollamos con el IGF nos ayudó a diseñar un instrumento de política novedoso para la minería en Argentina. Se trata de un instrumento progresivo (tributo de escala móvil a las exportaciones de cobre) orientado a captar la renta minera. Este instrumento aporta flexibilidad ante la volatilidad de los precios y reduce la incertidumbre en el régimen minero argentino, fomentando la inversión y fortaleciendo la recaudación” Pablo Gallo, se desempeñó como Jefe de Gabinete de la Secretaría de Política Tributaria del Ministerio de Economía de la Nación.

Esta historia fue publicada por primera vez en febrero de 2022 y actualizada en enero de 2024.