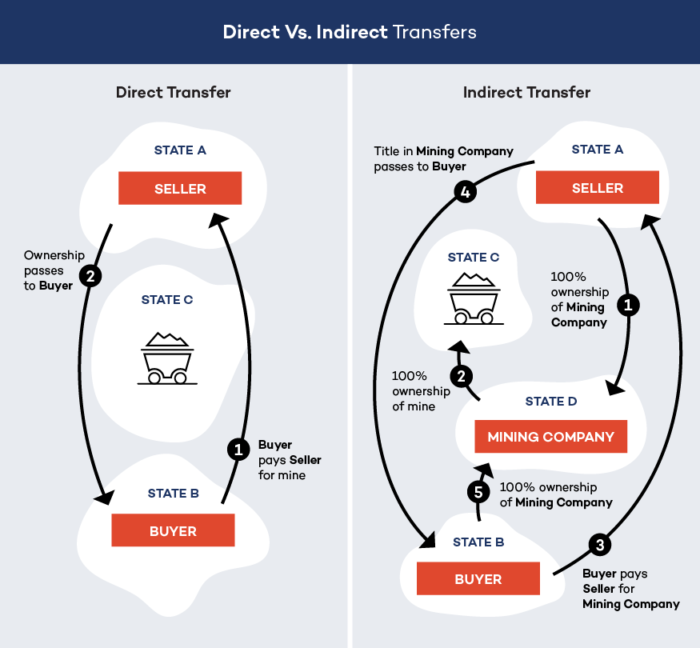

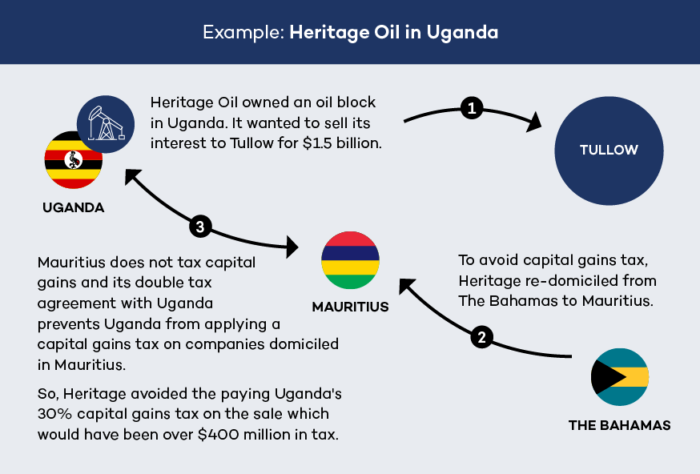

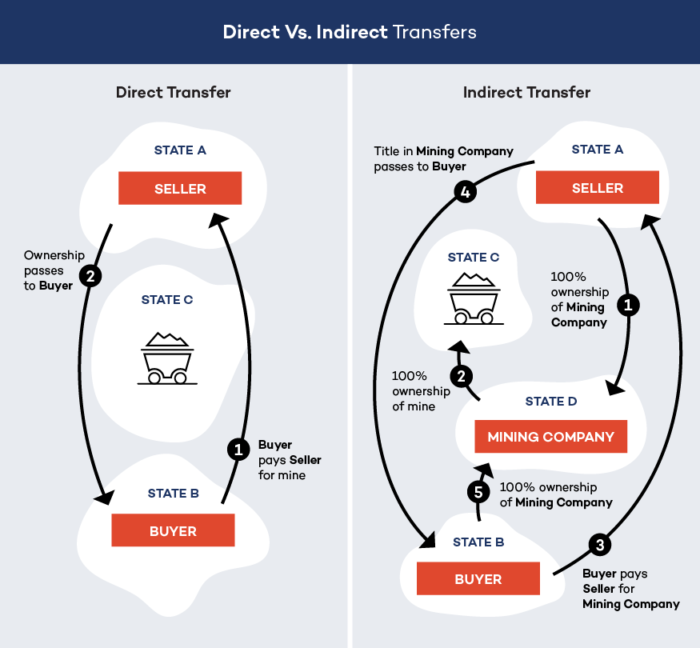

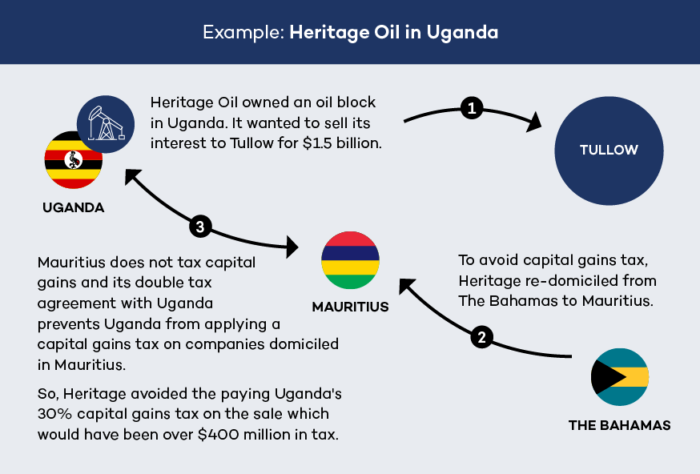

Transferring ownership of company assets (or the companies themselves) can generate significant income that many countries seek to tax as capital gains. Companies may structure transactions so that they fall outside the mining country’s tax base by selling shares in an offshore company holding the asset, often without notifying tax authorities in the country where the asset/company is located. This practice can also benefit from overly favourable provisions in tax treaties and has been the subject of multiple international arbitrations.

In recent years, many resource-rich countries have taken steps to review their domestic legislation and international treaty networks to improve their ability to tax offshore indirect transfers of assets. However, challenges related to the valuation of mining licences and assets for the purpose of taxation can make implementation difficult.