Companies can finance a mining investment through debt or equity. Interest payments on the debt are tax deductible by the mining company, while dividends that compensate for providing equity are not. Unless there are limitations on the deduction of interest, there is a risk that companies will allocate higher debt levels to the host country in order to pay less tax.

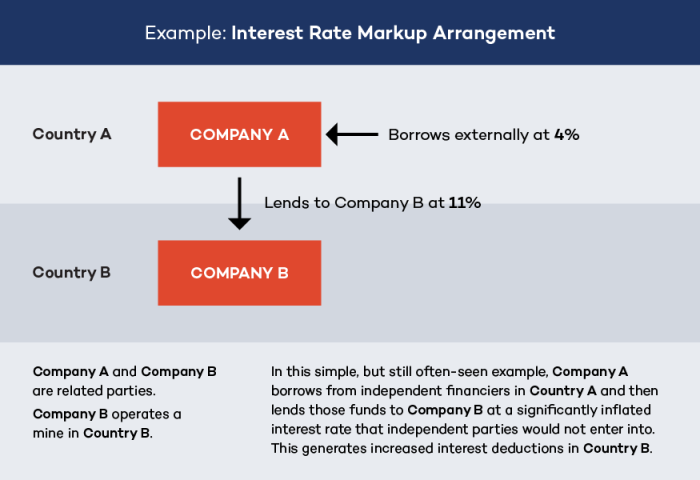

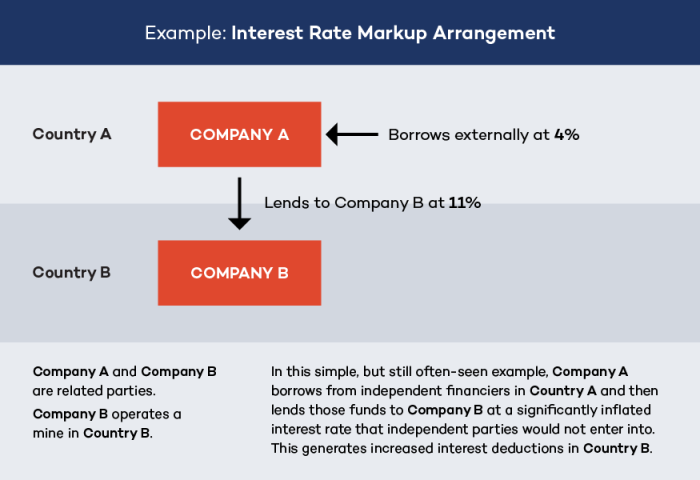

Companies may use related-party debt (e.g., from a headquarters entity to a subsidiary in the mining country) to shift profit offshore via excessive interest payments to the related entities. “Debt shifting” is not unique to mining, but it is particularly significant for mining projects that require high levels of capital investment not always directly obtainable from third parties, making substantial related-party borrowings common.

Many tax authorities are increasingly alert to the disproportionate allocation of debt to operations in their jurisdictions relative to elsewhere in the group and the terms at which loans are provided to local entities. In the absence of limitations on interest expenses, there is an elevated risk that companies will allocate higher debt levels to host countries.