Effective and inclusive ASM management helps governments realize gender equality, economic prosperity, and social development while safeguarding the environment.

Home Page

IGF Mining

The Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) supports governments to advance good mining governance for the betterment of communities, economies, and the environment.

We help governments around the globe further gender equality, support livelihoods, manage ecosystems, and optimize social and financial benefits in large and small-scale mining operations.

Our Work

We help governments strengthen their laws and policies to achieve their short and long-term sustainable development goals.

Artisanal and Small-Scale Mining

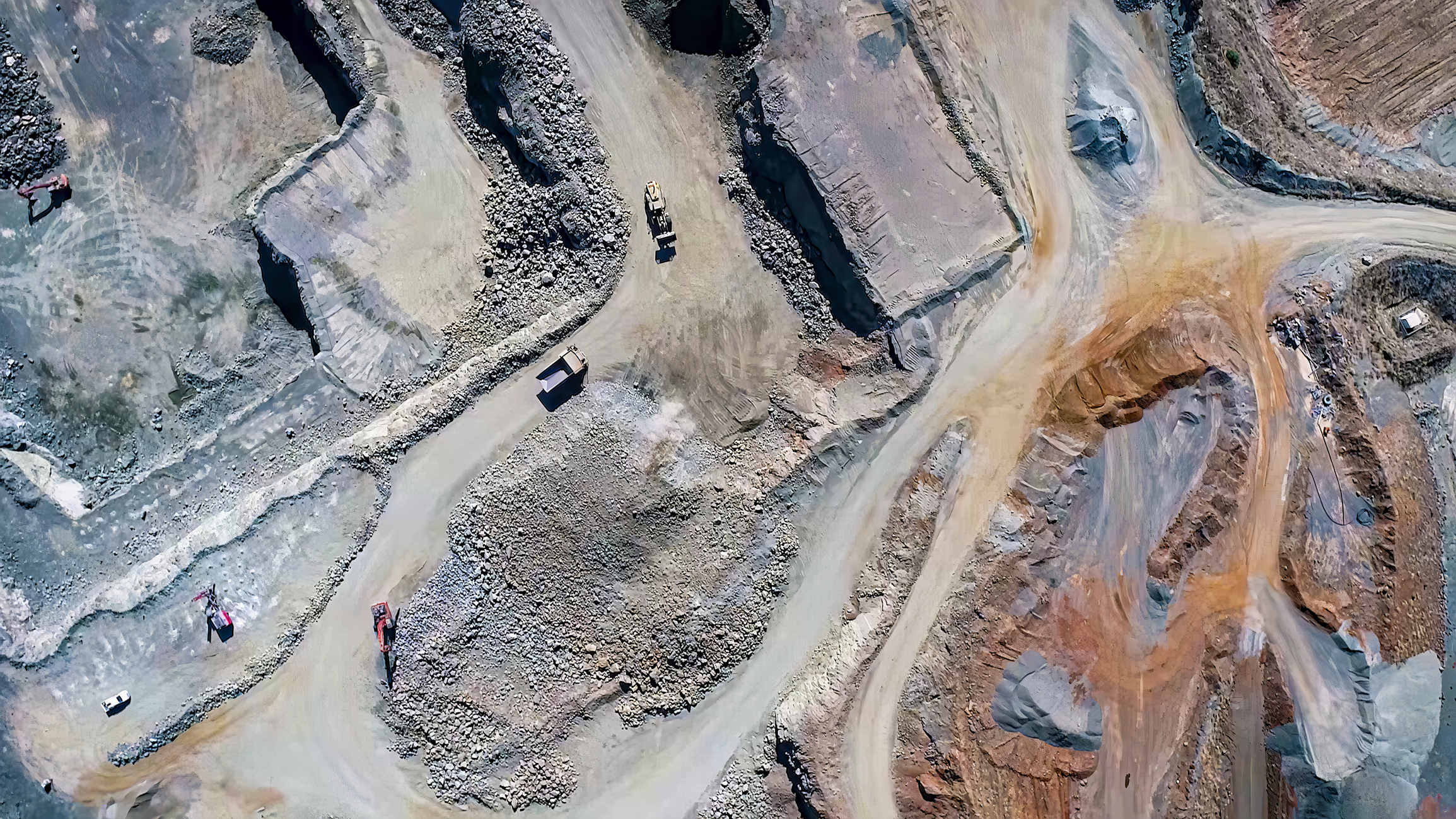

Environmental and Social Impact Assessments

ESIAs are a key tool for governments to anticipate and manage how mining operations affect communities and natural landscapes over the full life cycle of a mine.

Environmental Management

Effective environmental management regimes focus on key priorities such as water, biodiversity, mine waste, and emergency preparedness and response throughout mine development.

Financial Benefits

The IGF supports member countries to build and administer mining fiscal regimes that secure their fair share of revenues from the sector.

Gender Equality

As a driving force for sustainable livelihoods, communities, and environments, women’s meaningful participation in mining is critical to move the sector towards sustainability.

Local Content Policies

Policy-makers can use local content policies for inclusive, gender-equitable, and sustainable socio-economic development for governments, companies, and communities alike.

Mine Closure and Post-Mining Transition

Well-planned and executed mine closure and post-mining land use helps governments foster environmental integrity and the well-being of local communities.

New Technologies

New mining technologies are rapidly transforming the mining sector with major implications for workers, communities, companies, and governments.

Events

IGF 20th Annual General Meeting

PDAC Side Event | Prosperity Unearthed: Building trust through benefit sharing

IGF at 2024 Mining Indaba

Subscribe to our newsletter

for updates on policy issues, research, and events.

Blog

April 10, 2024

Variable Royalties for Mineral Price Volatility in the Energy Transition

Careful design and implementation of these variable royalties could prove worthwhile for many countries, especially as mineral price volatility is likely to increase in the energy transition.

January 10, 2024

Argentina Pulling Policy Levers to Maximize Lithium Benefits

Argentina is using a number of policy tools to ensure lithium extraction fully benefits the nation.

September 26, 2023

Mining Fiscal Tools Should Offer Simplicity, Participation, Fairness, and Compensation

Governments want innovative and effective fiscal policies for the mining sector that offer simplicity, participation, fairness, and compensation.

Announcements

The IGF Welcomes Comoros as 85th Member Country

Chile Joins IGF to Contribute to the Global Transition

Timor-Leste Joins the IGF to Support National Mining Development Goals

Our Impact

Our work creates policy solutions for a more sustainable mining sector.

Argentina Gets Innovative With Export Duty, Uses Financial Modelling to Unlock Economic Potential

The IGF helped Argentina to financially model mining development projects to assess how fiscal regimes may be affecting mining investment decisions.

Establishing a Reference Price for Bauxite Gets Fair Returns for Guinea

The IGF worked with Guinea to establish a benchmark price for bauxite.

Transfer Pricing Audit Capacity Pays Dividends for Mongolia

The IGF partnered with international organizations to help Mongolia strengthen revenue collection from its mining sector.

Laying the Foundation for Mine Closure Legislation in Argentina

The IGF played an instrumental role in establishing national guidelines for mine closure policies in Argentina.

Fostering Advocates for Gender and Mining Governance in 133 Nations

Our expanded e-learning course reached a wider audience, including French- and Spanish-speaking participants in Latin America and West Africa.